Why you should buy your next car online. Humans interact better, technology does the rest

-Hey dude, I’m gonna buy a car today.

-Really? Where you gonna go?.

-Where? I’ll do it from my couch.

-Really?

This might seem like a dumb conversation between two mates, but it is pretty much what we can expect to hear from now on. On the one hand, we have the brave tech guy, he’s confident about spending a few thousand bucks buying a new “toy” online. On the other hand, we have his bemused friend, who thinks that buying a car still means visiting dealers, spending a ton of money, dealing with the hassle and playing hardball. Happily, the friend’s view of the car world is already outdated. Welcome to the real digital transformation.

Over the last 5 years, we have seen a gradual and inspiring revolution in the automotive sector. And startups haven’t been the only ones disrupting the market; OEMs have also been working hard to update and develop their entire value chains. And this combined effort has completely transformed the market, which is worth a whopping $1 trillion per annum (source: Market Research, Global Automotive Manufacturer 2016). So, what’s new?

Frost & Sullivan predict that 4.5 million cars will be sold online by 2020. What’s more, they forecast a drastic decrease in showroom visits and a huge increase in online searches by potential new car purchasers.

So, when our tech guy talks about buying a car using an app, he’s not dreaming about the future or just making some kind of joke. He is living in the here and now… which means that if you want to sell him a car, then you’re gonna have to start letting him drive his dream ride, in the way that he wants, when he wants. And that is probably not the way you currently know how.

For manufacturers, the first step on the road to change is to transform and adapt their process. There are examples aplenty all over the globe. BMW started selling cars online in the UK thanks to the unprecedented support of its retail partners. Hyundai launched a partnership experience with Rockar, to invest in and nurture potential customers as a way of complementing its traditional model. Probably the most well known overhauled retail model is Tesla´s; as an aside, we still find it confusing that some OEMs are battling against Tesla when clearly the firm is only seeking to enhance and enrich customer relationships. Tesla is also expanding its business in a way that is very popular in the fashion retail sector: it is opening branded super stores. But even though Tesla is leading by example, all of the major OEMs are improving their businesses to extract market insights. Audi has launched its own Audicity stores and co-ownership programes. Ford is doing something similar.

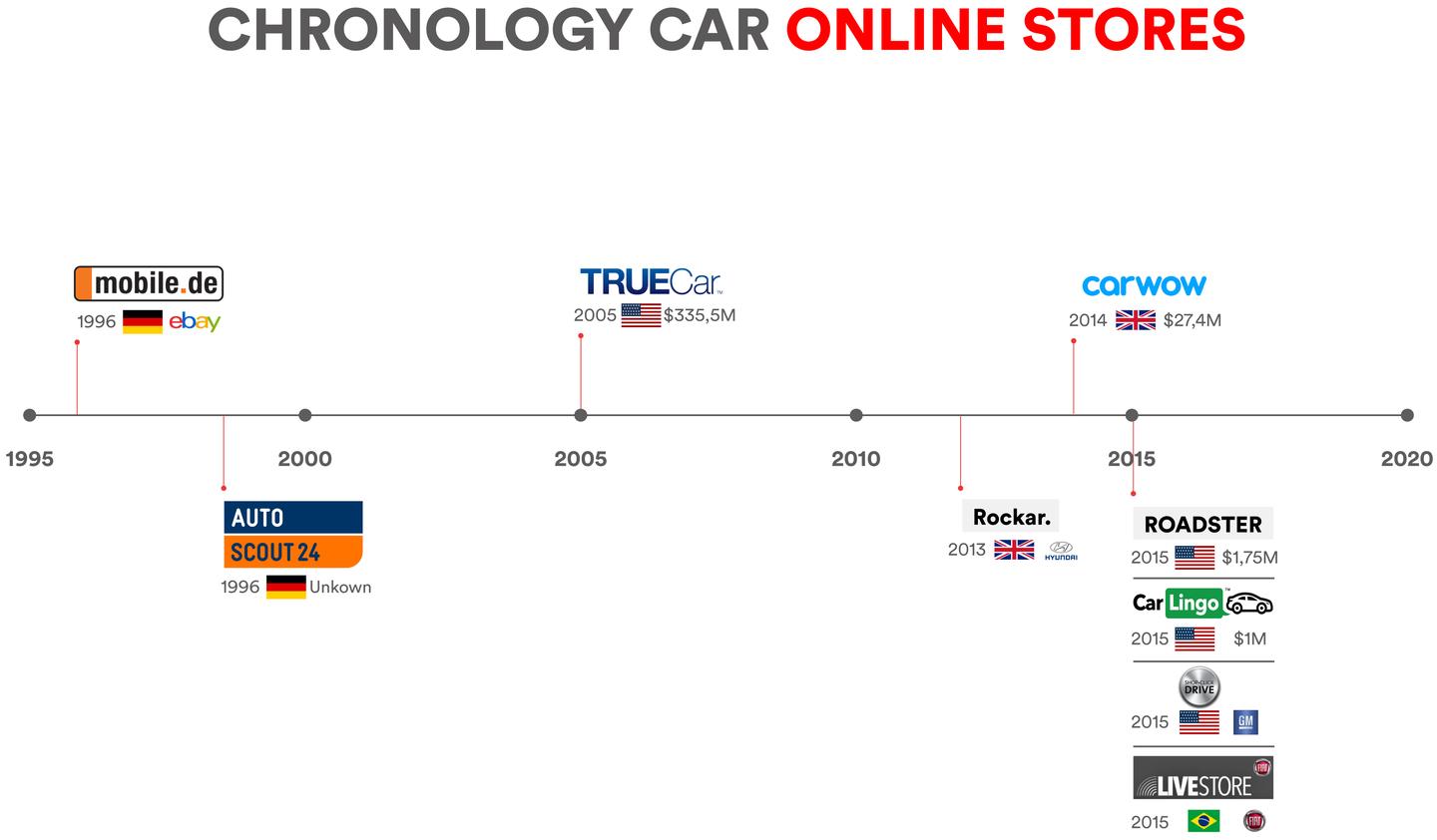

(In this infographic are only the e-commerce that sells new cars)

All of them have been developing new retail concepts and harnessing technology to enhance their processes with partners, such as Evoxx and Zerolight. Audi and Volvo are eager to add VR to their concept stores and even to dramatically increase search and test drive experiences but despite this technological integration, the most interesting insight of all is that these initiatives are trying to measure customers’ behaviour, rather than predict or anticipate it. According to CDK Global, just 14 out of 4.000 people surveyed actually like the current car buying experience. This raises a number of questions. When should OEMs start to build a relationship between their brand and potential customers? How can existing relationships be enhanced? All of the major players are trying to create experiences around the product (the car). Lexus, for example, is opening its third interest concept or relational store. Ds Automobile in Paris and China and Mazda in Barcelona also believe in other complementary ways to create value links.

Their ultimate goal is to target and engage all types of customers wherever they may be. Fiat Brasil has its own Fiat Live Store, a concept that is being followed by other players in the sector, including the Spanish firm Whisby and the London-based Goinstore. On top this, geo-strategies are becoming ever more relevant. Why do people in Asia use e-commerce to pre-purchase cars? And why are test drives delivered by partners, when they have really high purchase conversion rates (more than any other initiatives)? At first sight, OEMs are truly committed to finding out what to unify in the retail process and what should be totally different. The path will be Glo-cal, mobile, experience full; a total connected approach.

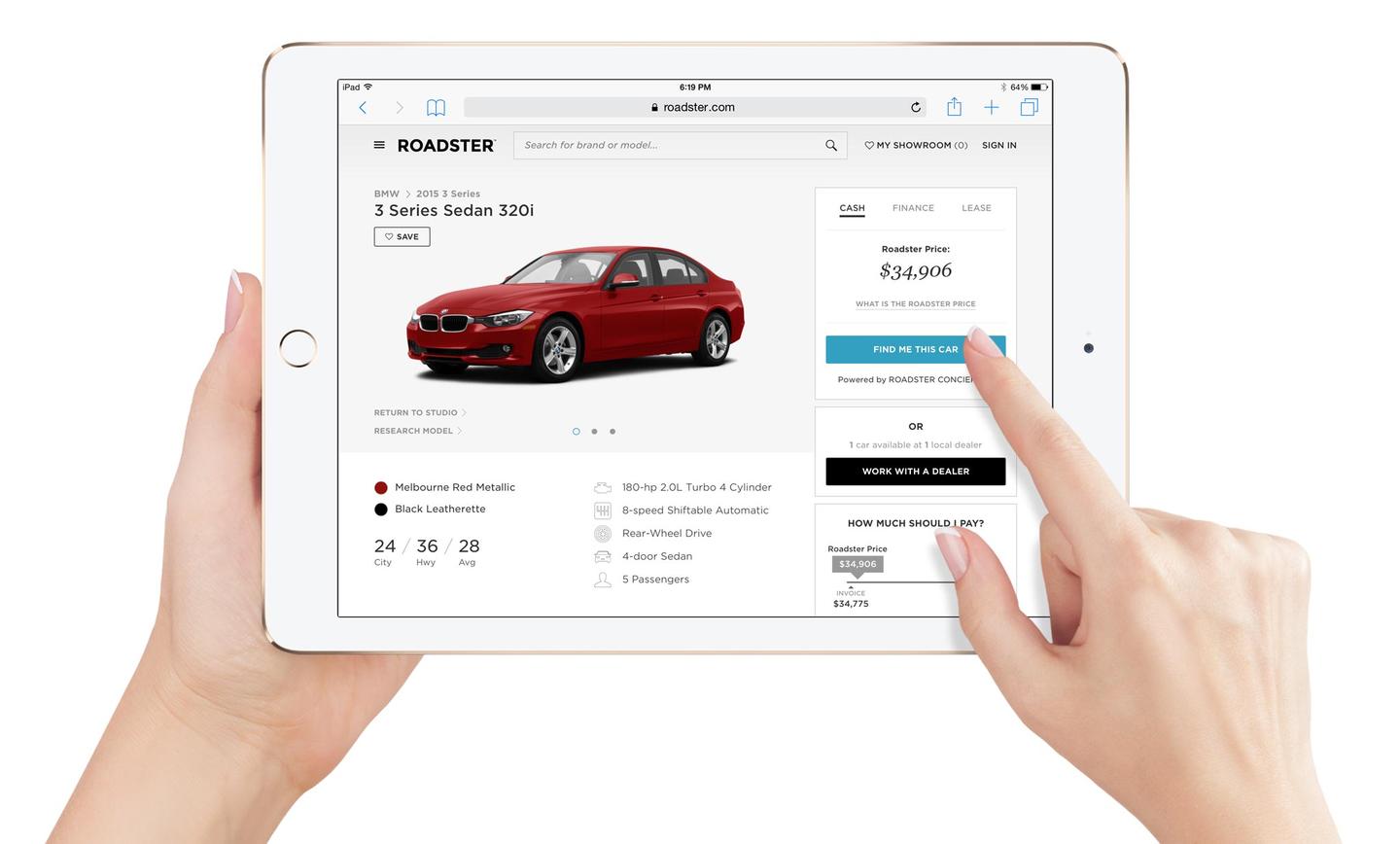

This makes a lot of sense if we think about what startups are doing. New players have already launched a whole host of damn good things in different markets. At the top of the leaderboard of brave starters is TrueCar, but many more startups are in the race to become key players in this space. Roadster is improving the TrueCar experience in certain ways, with its awesome design experience. Carwow is delivering a comprehensive online service, supported by a dedicated team on the other side of the Atlantic. Both are focused on drop down barriers to extending search periods to online purchase. It is not easy, people need each other when things turn serious. Both companies know that the goal is not to change everything, but rather to improve it. Add people when they are needed, remove any pressure when they are not. And it works. Many companies are working to enhance current players to catch up with this fully digital experience. Drivemotors is working to implement technology, which could be used by customers in traditional dealer players. There are other initiatives (some of which are still in their infancy but nonetheless very inspiring) including the Tinder of the car industry, Wyper.

This last player has really disrupted the Used Car market. But that is the theme of a separate post. It is a whole other world, which deserves a different set of analysis and discussions about players such as Beepi, Getaround, Carvana, Shift, Vroom, Carsrping plus others based in Asia, Like Bochewang, Che300, and Chemao We will talk about that sector another time, together with the market for spare parts and maintenance…

In the here and now, if we turn our focus back to the core proposition of this post, we can see that retailing is changing fast and not only in the way that OEMs and their partners are doing business but also in the way that customers are behaving. We are seeing increasingly more digital supported research and discovery, combined with searches for instant solutions (fast test drives and even online processes to start making purchases). And the ecosystem is expanding. Along with the aforementioned new digital retailers and test drive partners, we are seeing new solutions emerging. For example, AutoFi is enhancing the financing process for both new players and traditional car dealers. Forevercar is giving owners an easy to use tool to extend the warranties on their vehicles.

Overall, the market is heading towards a more on-demand experience, to maximise convenience for everyone. That’s the way we all want things nowadays. Conversations like the one between the two guys at the start of this post are taking place in bars, on social media and even on automotive forums, every single day, all around the world. It’s time to transform those conversations into opportunities. And that’s a lesson that many Automotive players have learned from other industries, like media and music. There’s no need to reinvent the wheel, but there is a need to move quickly, to keep ahead of the curve.

Exciting Times!

At B4 Motion, we are following more than 200 carefully selected companies, which we think are set to transform part or even the whole retail automotive market over the next few years. We are comparing their progress in different markets and regions and we are playing around with their products. We are a fully operational Venture and Lab offering the latest news and views, so stay tuned to find out when a trend is about to become mainstream.

And that is why we have created Trive, our first Venture Builder startup. Trive combines the global vision of all of the players in the automotive sector (OEMs, retailers, startups and emerging technologies) to offer a distilled approach for discovering, trying and purchasing a new car. We have incorporated all of the latest trends into the business model, along with research about real customers and retailers that we have been conducting for more than 12 months. And the results show the need for a major upgrade of the automotive retail business. B4Motion Labs has invested €2 Million in the launch and operation of this startup through its Beta, with the aim of developing its initial MVP. We don’t know whether you’ll fall in love Trive immediately, but we are pretty sure that it will have a significant impact on you when you “play” it for the first time. If you are still trying to figure out what exactly we are building at Trive, then you should maybe read this post again ;-).

It’s too early for us to give you any more info at this stage, but watch this space for the latest developments. You can also follow TRIVE evolution on the website!

Welcome to the drivevolution. And keep your eyes peeled for more B4Labs startups, coming soon.