Toyota Portfolio and investment strategy

WHERE OEMs ARE INVESTING

We have conducted the following analysis of Venture Capital activity using data from Dealroom and CB Insights. We have corroborated this data and provided context by tracking different media reporting declarations by key people within the company.

We have tracked investment from 2015 to the present day (May 2020). We selected 2015 as the starting point for two reasons. Firstly, and most importantly, 2015 was the year that most OEMs started using the word “mobility” instead of “automotive” - this represented a paradigm shift in their strategic plans. Secondly, it was the year that we launched B4Motion, at least the year it went on the radar.

WHAT WE ARE SHARING

Funding activity: a table with the number of deals and funding totals by year.

Top funded companies: a list of the most well-funded firms in which the company under analysis has invested. Not to be confused with the amount of money the company under analysis has invested.

Deal share by stage: the investment phase at which the startups that the company under analysis has invested in by year

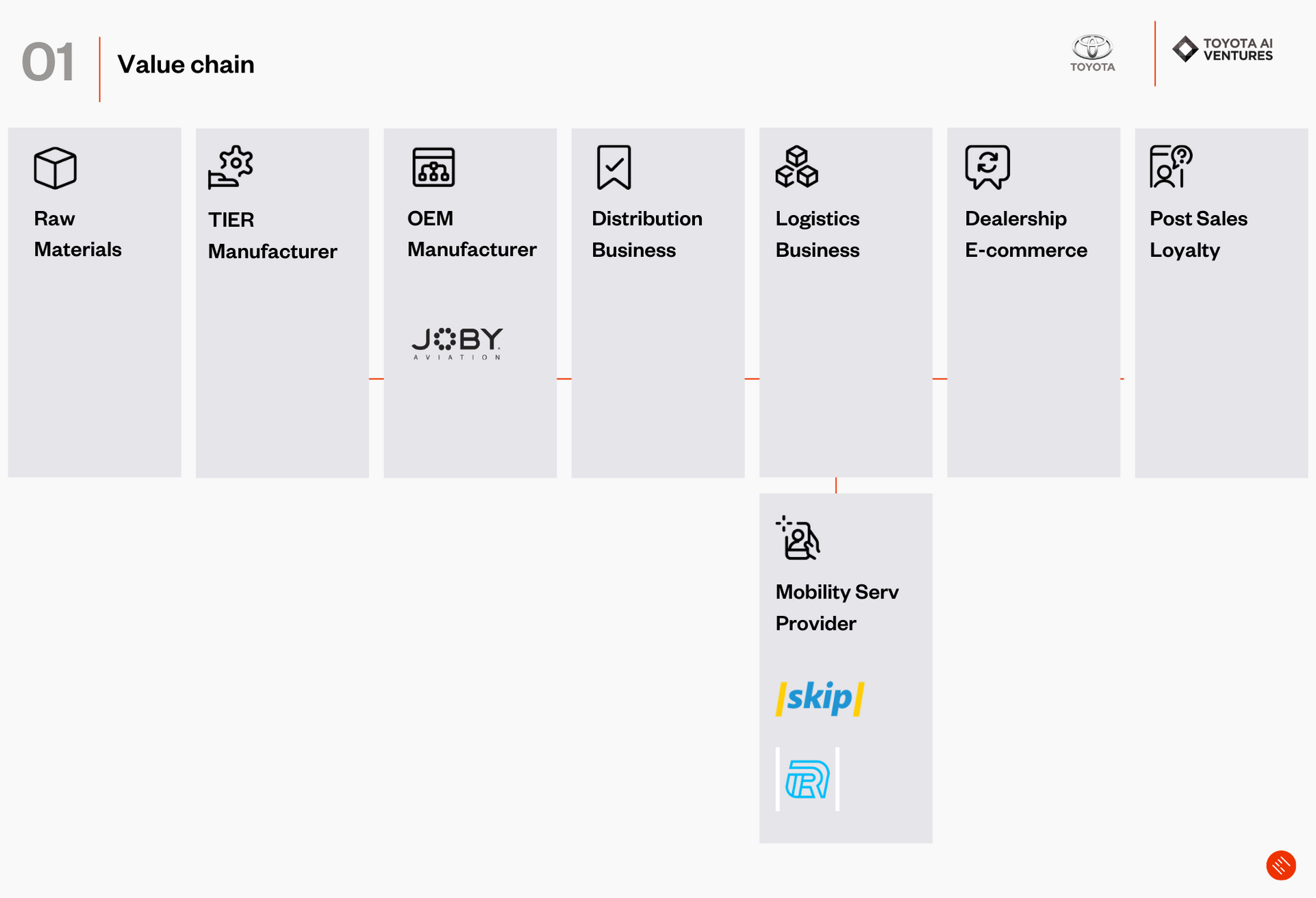

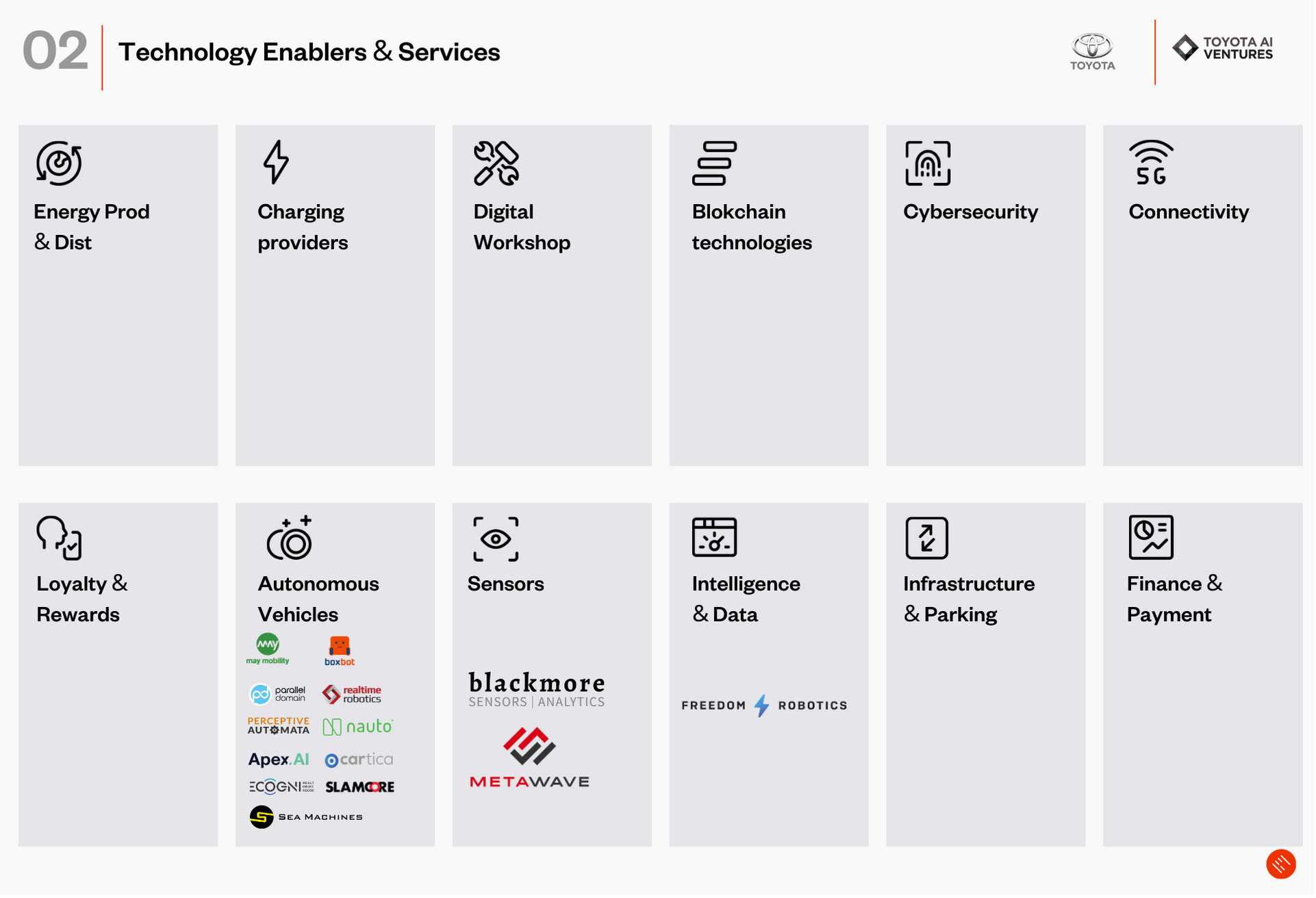

Value chain/enablers and services: Supply chain shows in which part of the automotive value chain the invested startups are located. Enablers and services is a market that traditionally has not been inside the automotive business, but which is now key for its future.

We treat a deal as an acquisition when between 80% (corporate majority) and 100% of a company is purchased. Due to the importance of this move, we are going through all the companies in this category. We do not include exited companies in our charts.

PORTFOLIO VISION

ADVANCED MOBILITY COMPANY

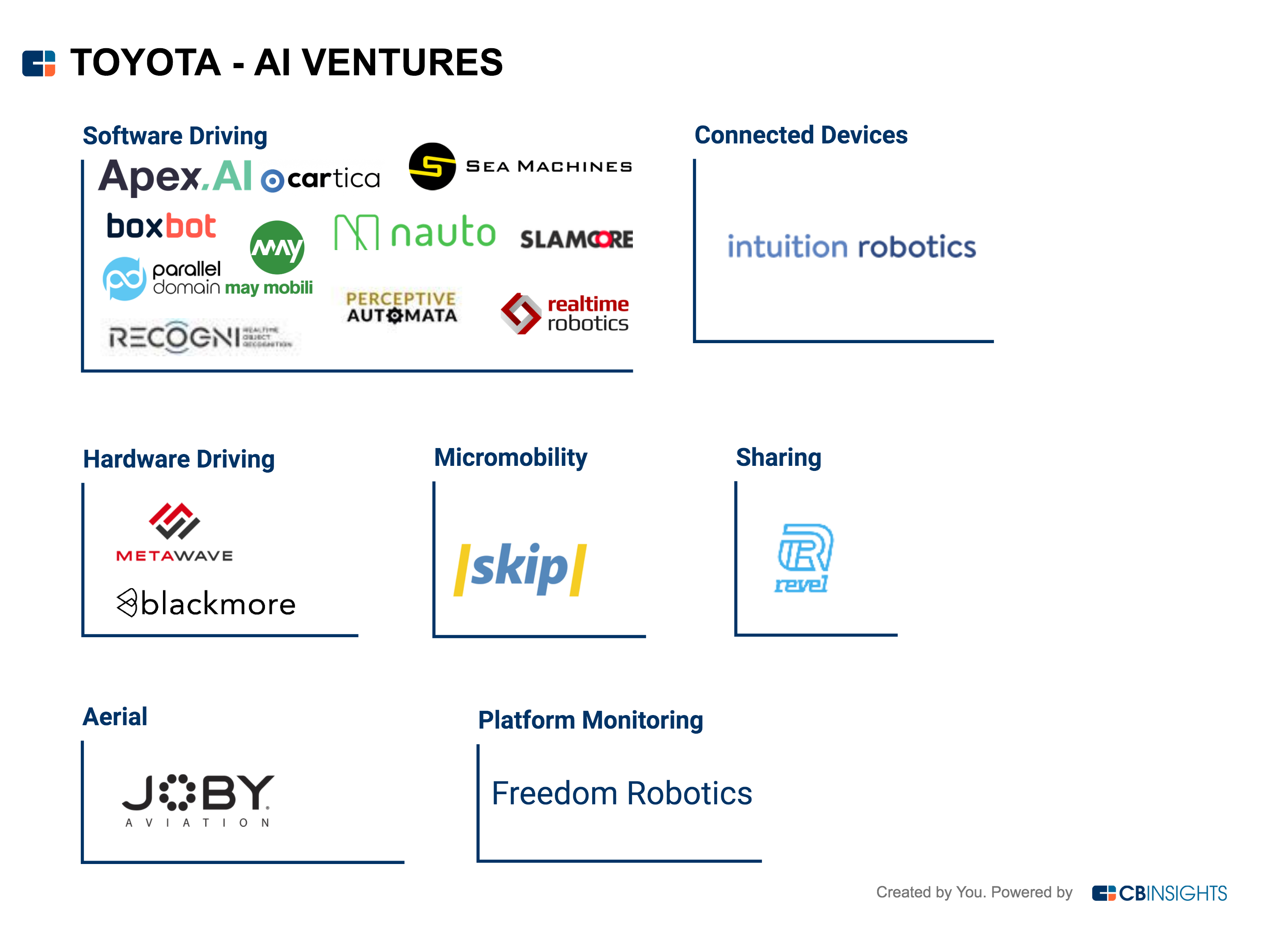

We have detected 2 corporations closing deals in the VC space under the umbrella of the Toyota Corporation: Toyota Corporation itself and AI Ventures. It is very important to note that both divisions have the same investment in the platforms we use to track VC activity (CB Insights and Dealroom). We understand that Toyota moved all of its Venture activities from TRI (Toyota Research Institute) to AI ventures back in 2017 when this new division was created. We have made that assumption because it was Jim Adler who made the decision; he also serves as executive advisor at the TRI. Jim Adler is the Founding Managing Partner & Board Member of Toyota AI Ventures and has served as a Board Member since its creation. In light of the above, we have focused all of our attention on investment activity by AI Ventures regardless of the fact that it was created in 2017 and we are analyzing from 2015 to the present day.

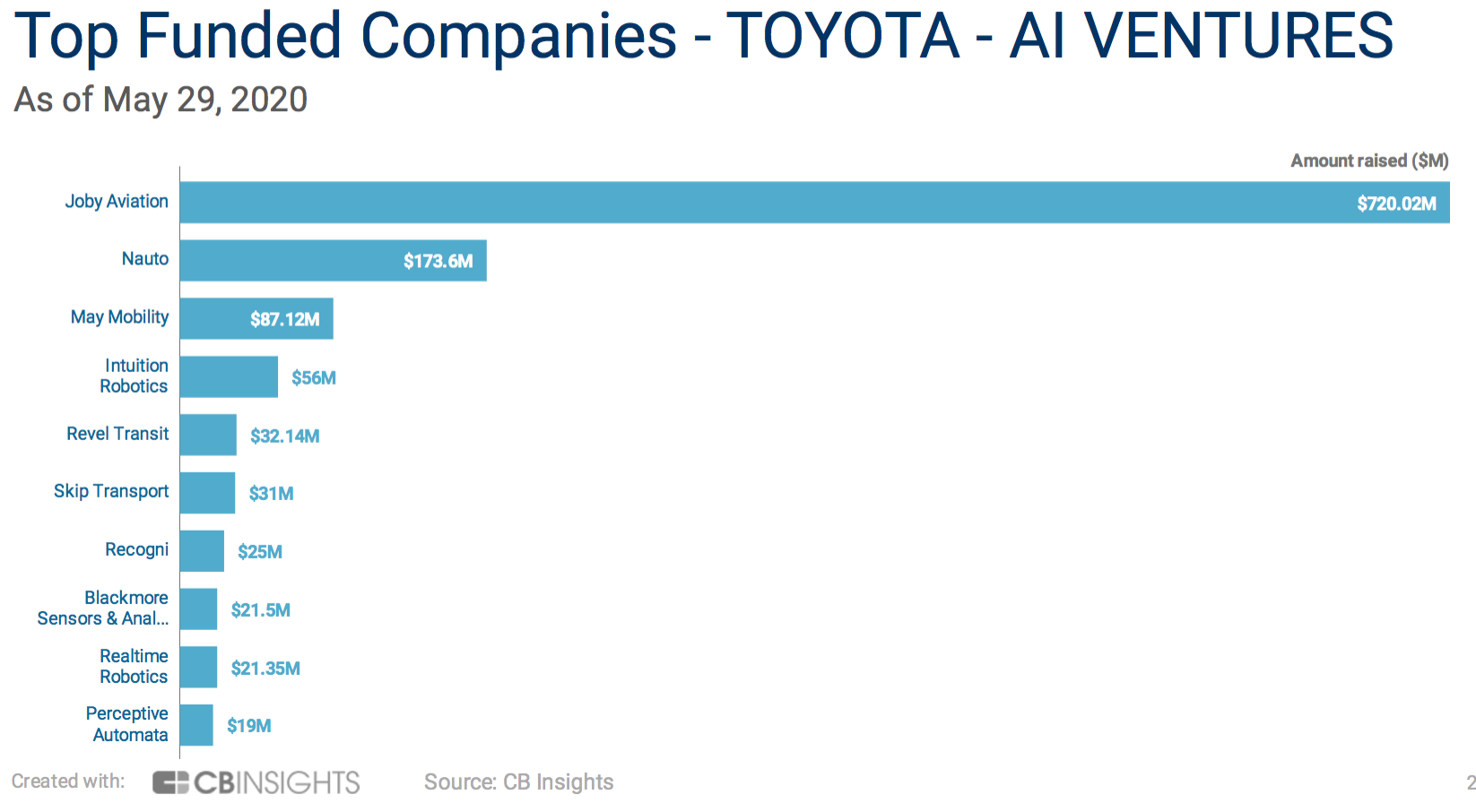

AI Ventures has a portfolio of 19 companies, including 1 exit (5.26%), 0 acquisitions (0.0%), and 18 invested companies (94.74%).

At this point, it is worth highlighting Toyota's significant internal R&D capabilities.This is because if we only look at their investments in startups then it is easy to misunderstand where the company is focusing to remain relevant in the future.

Automotive companies are by their nature the companies with the highest investment in R&D of any sector. And Toyota is the third largest of them all with a 9.59 billion yenes year investment in R&D in 2018, 10.46 billion yenes in 2019, and 11.10 billion yenes in 2020. Akio Toyoda calls the current context and investment in R&D the fight for survival. And the survival depends on developing cutting edge technology as it reshapes the automotive industry.

One of the new key elements within this strategic effort is TRI's collaboration with Aisin Seiki and Denso to co-create TRI-AD, which has financed an “investment of $2.8 billion to hire around 1,000 employees in order to develop software systems that can powerfully boost self-driving vehicles over the next few years.” The goal of this new division is robotics, which is much bigger than autonomous transportation. The main three pillars of research are autonomous technology, indoor mobility (robots), and new materials for battery-and hybrid- propulsion vehicles. This lab is linked with 4 other divisions to promote innovation in the ecosystem: Toyota Ai Ventures (analyzed below), TRI-AD, Toyota Connected, (connected devices and mobility data management) and CSRC (Collaborative Safety Research Center - which researches human-technology integration, crash avoidance... ).

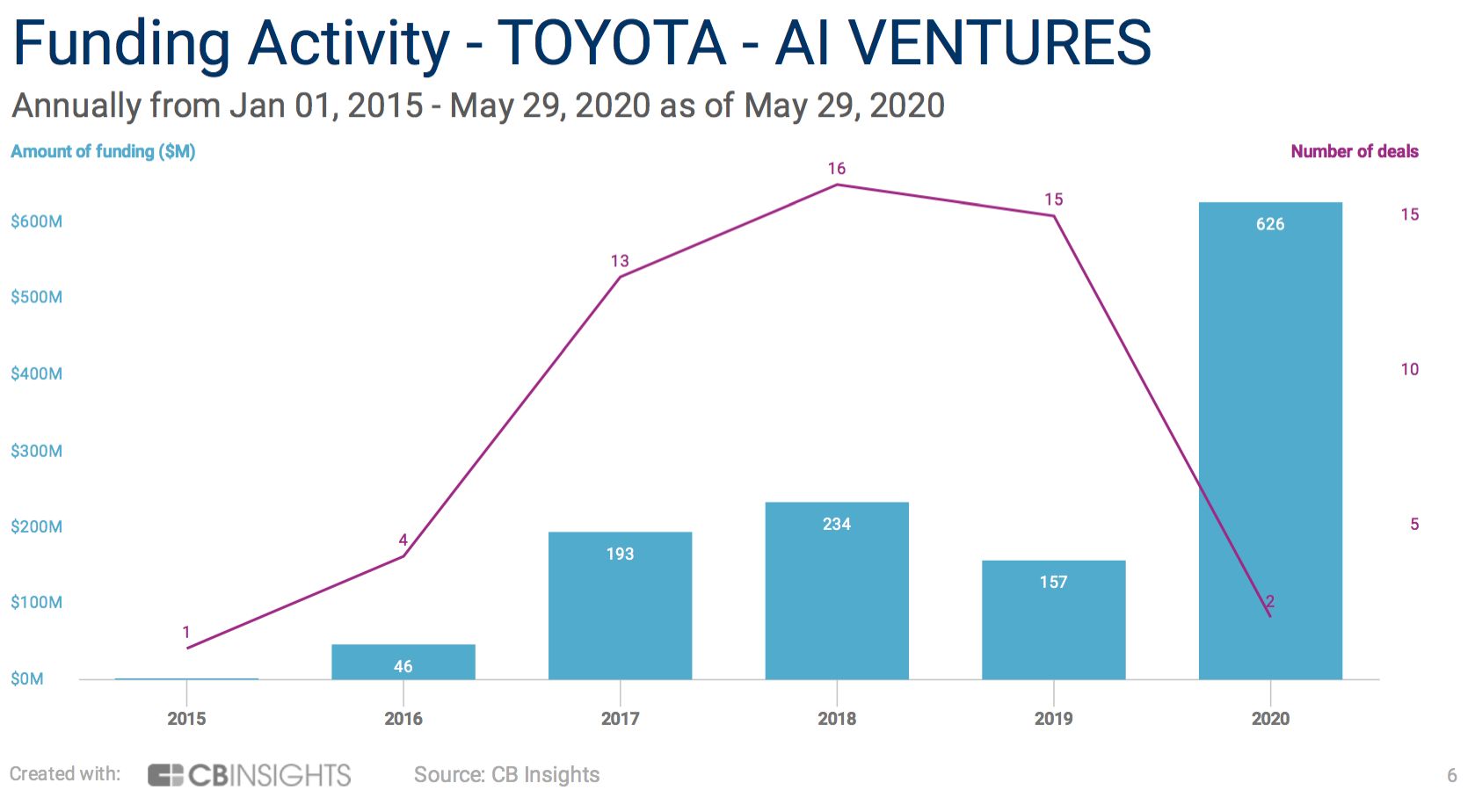

CONTEXT: FUNDING ACTIVITY

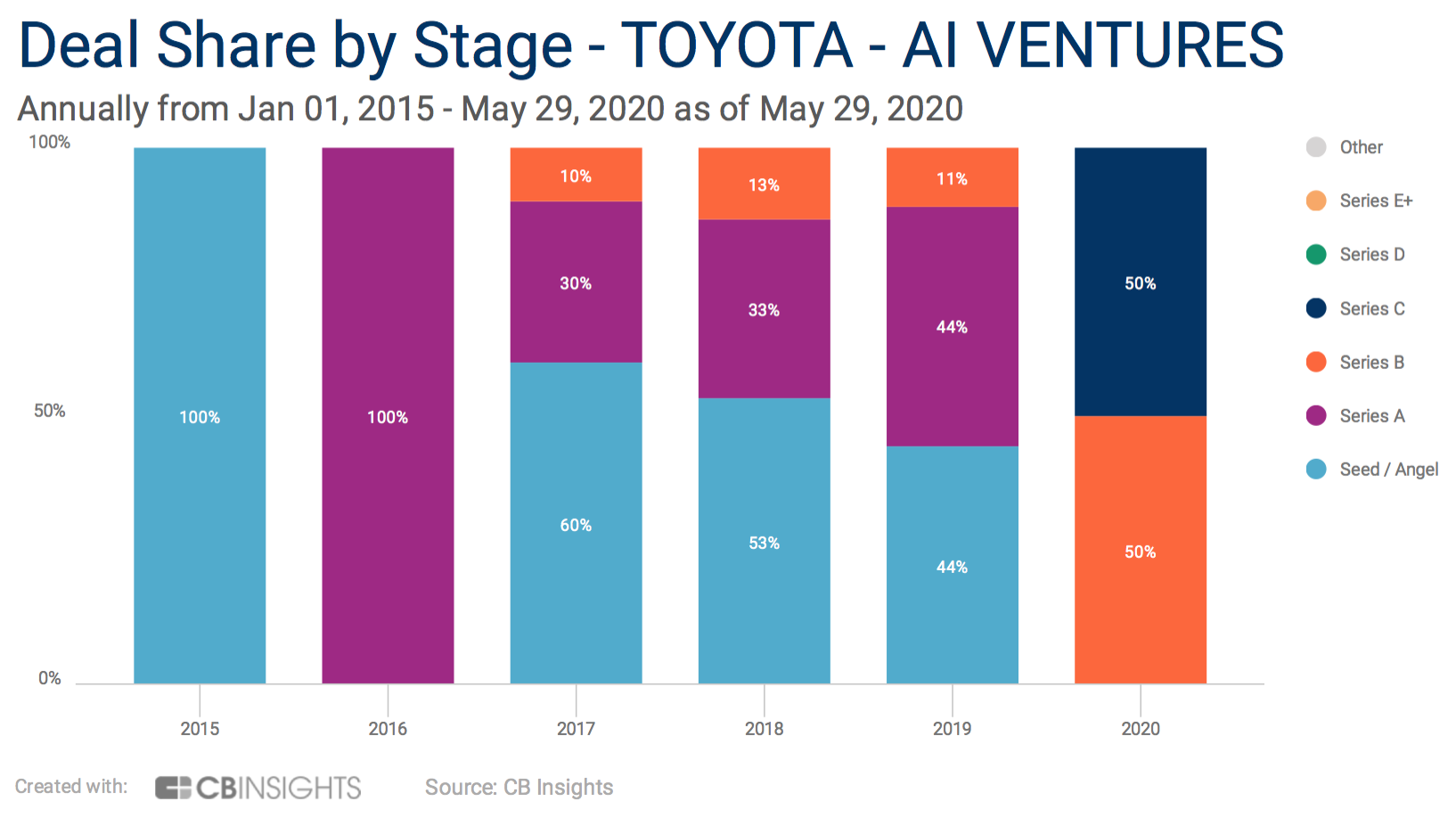

To date, the startups invested by Toyota, among others, have raised almost the same amount of money in 2020 ($626M) than all the previous years accumulated ($637M). this effect is due to only two deals: Intiution Robotics and Joby Aviation (mostly by the second one). The stage where Toyota has invested have sifted too in 2020. Previously, the stage that dominates was seed one. Accounting for 100% in 2015, 0% in 2016, 60% in 2017, 6¡52% in 2018, 44% in 2019 and 0% in 2020.

Conclusions

The obsession with robotics

The company is fully embracing this path almost to the point of exclusivity. TRD and AI Ventures are proof of this. It is clear that if it is able to gain a position as a relevant player in this field its future is as bright as it can be.

Robotics has way more potential as a market than autonomous vehicles. In fact, for a strategy so critical for mobility, autonomous vehicles constitute just the development of systems that give robots the capacity to perceive their surroundings and react to them. If you think about it, one of the pillars of TRI was indoor mobility, and here it is targeting two clear markets: logistics and elderly care. Both cases need a clear understanding of what is happening because both are going to face complex and mutable environments.