Volkswagen Teardown

OEM Investment & Strategic M&A

------

CONTEXT

We have conducted the following analysis of Venture Capital activity using data from Dealroom and CB Insights. We have corroborated this data and provided context by tracking different media reporting declarations by key people within the company.

We have tracked investment from 2015 to the present day (March 2020). We selected 2015 as the starting point for two reasons. Firstly, and most importantly, 2015 was the year that most OEMs started using the word “mobility” instead of “automotive” - this represented a paradigm shift in their strategic plans. Secondly, it was the year that we launched B4Motion, at least the year it went on the radar.

This document presents information using 6 charts and 2 tools.

Charts:

Investment landscape: A multi-category map with all the mobility investments from each corporation categorized by segment. We also list where the charts are embedded. This resource comprises different sheets.

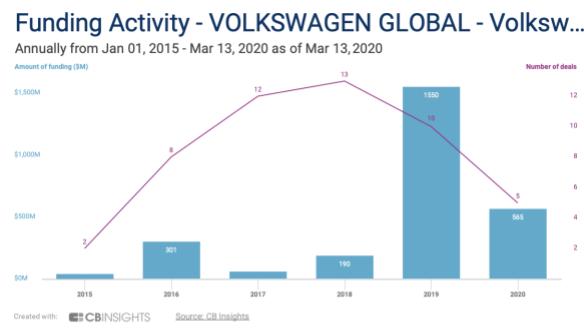

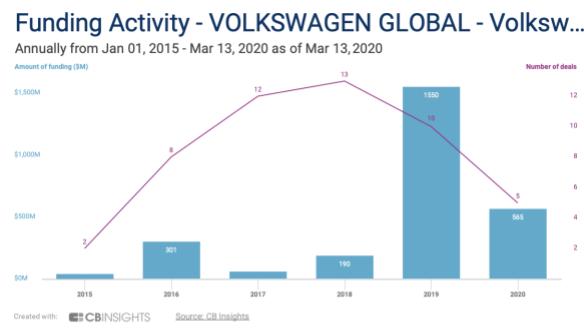

Funding activity: a table with the number of deals and funding totals by year.

Top funded companies: a list of the most well-funded firms that the company under analysis has invested. Not to be confused with the amount of money the company under analysis has invested.

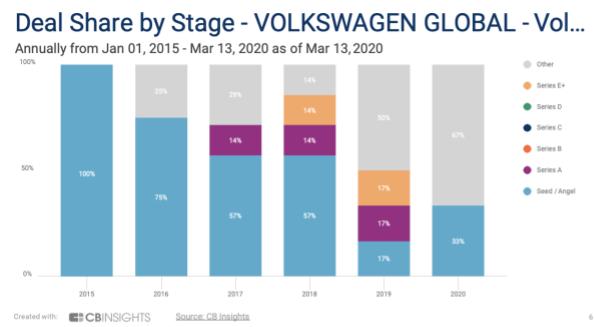

Deal share by stage: the investment phase at which the startups that the company under analysis has invested in by year

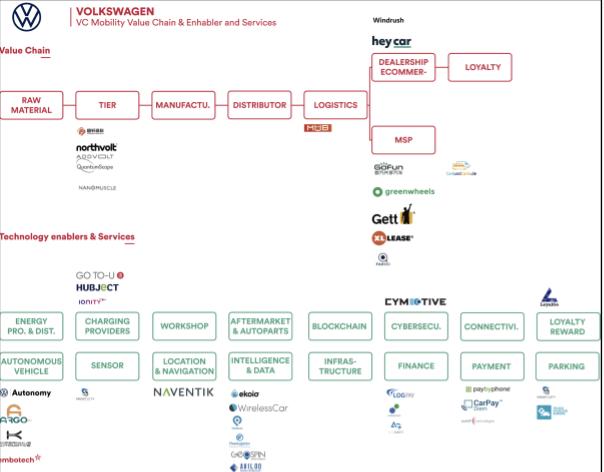

Value chain/enablers and services: Supply chain, shows in which part of the automotive value chain the investee startup is located. Enablers and services, a market that traditionally has not been inside the automotive business, which is now key for its future.

We treat a deal as an acquisition when between 80% (corporate majority) and 100% of a company is purchased. Due to the importance of this move, we are going through all the companies in this category. We do not include exited companies in our charts.

00 | VOLKSWAGEN

We have detected seven entities operating under the Volkswagen Corporation umbrella that are closing deals in the VC space: Volkswagen Group, Volkswagen Financial Services, SAIC Volkswagen, Volkswagen Bank, Volkswagen Ideation: Hub, Windrush Volkswagen and Volkswagen Financial Services Startup Battlefield.

Volkswagen has listed 57 companies in its deal-flow since 2015. Of those, 48 relate to mobility (84%): 1 was an exit (2.08%), 13 were acquisitions (27.08%), 16 were investments (33.33%), and 12 (25%) were incubated or accelerated. It’s important to bear in mind that Volkswagen Autonomy is a spin-out entity, and Windrush Volkswagen and SAIC Volkswagen are not investing in anything.

We have defined some general categories so that we can start curating the info. This doesn’t mean that we are going to delve into a detailed analysis of all of them. We are going to deep-dive into the mobility sector only. But, we have performed this analysis to avoid companies such as Home IX, which develops technologies that could be used in mobility but which does not focus on mobility, from being classified as a mobility company.

We have deep-dived the venture activity of each arm. And of course, we have the conclusions and future projections extracted from all this information. If you want to know more, write to hello@b4motion.com. And to keep up to date with mobility movements, follow us on Twitter, Linkedin, Medium and on our newsletter.