Micro–mobility: State of the art

Introduction

Then it changed and the personal last-mile mobility emerged thanks to bike-sharing and all the PVM (Personal Mobility Vehicles) revolution, yes e-scooter mainly but not only. With this new services, the focus was put in the 3 miles mobility hassle.

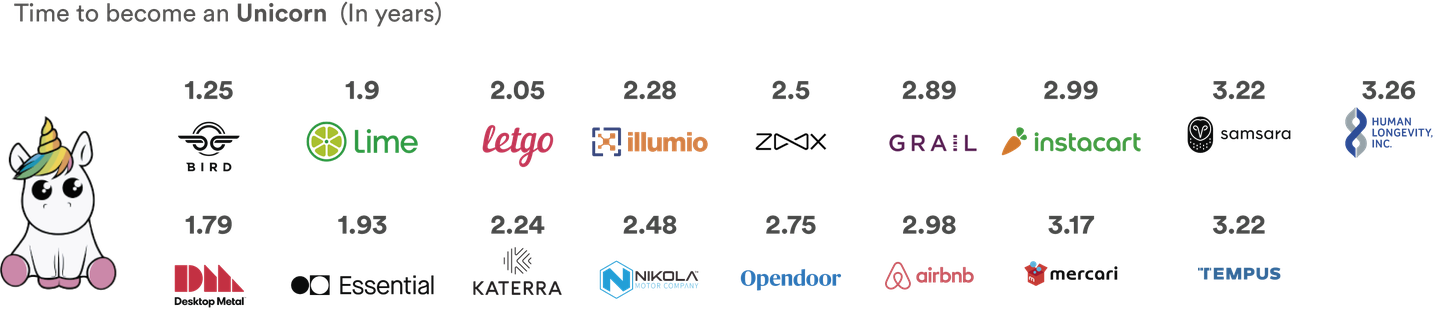

And then bird emerges, the fastest startup in the history to reach unicorn status. Following Bird, tens of companies also emerge or pivot into it.

Source: B4Motion

The game has changed

The key resides in the analysis of the miles driven in metropolitan areas. Take for example the US and Spain. In the US 45.6% trips in metropolitan areas are under 3 miles. Meanwhile, in Spain, we made 57 million trips year, 37% of them are under 3 km.

So this has shifted the market. From competition based on assets (bikes, motorbikes, cars…) to competition based in service targeting trips below 4- 5 km (distance).

Market forecast

Frost & Sullivan. Predicts that the revenue will go from less than 1 billion in 2016 to 20 billion in 2025. Fleet size will grow from less than 3 million in 2016 to 12 billion in 2020.

Roland Berger. Predicted that the market will grow to annuals CARG between 20% to 30% in 2020. This will lead to a market revenue between EUR 3.5 to 5.2 billion by 2020, driven mainly by the growth of e-bikes.

Credence Research. predicts that the global market for bike-sharing services will grow at a compound annual rate of 12.5% between 2018 and 2026.

Market Insider. The Micro EVs, e-Bikes, e-Scooters, e-Motorbikes, Mobility for Disabled will reach $35 billion in 2027.

Yeah, you should be thinking “the data differs a lot”. It is true different years, different market considerations (bike-sharing Vs micro-mobility), but what matters is that all point towards the same direction: micro-mobility, last mile human mobility services are here to stay.

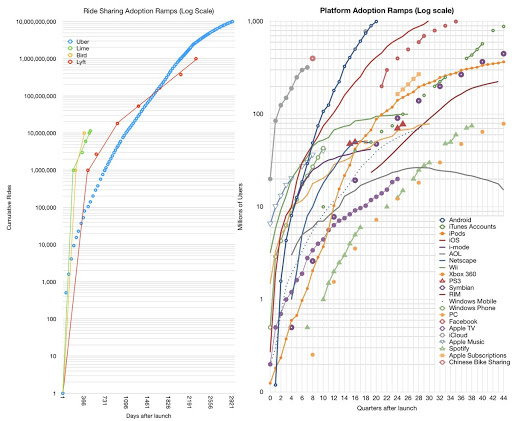

Adoption rates

Source: Horacio Dediu

Nothing much to add.

Size measure by the investments

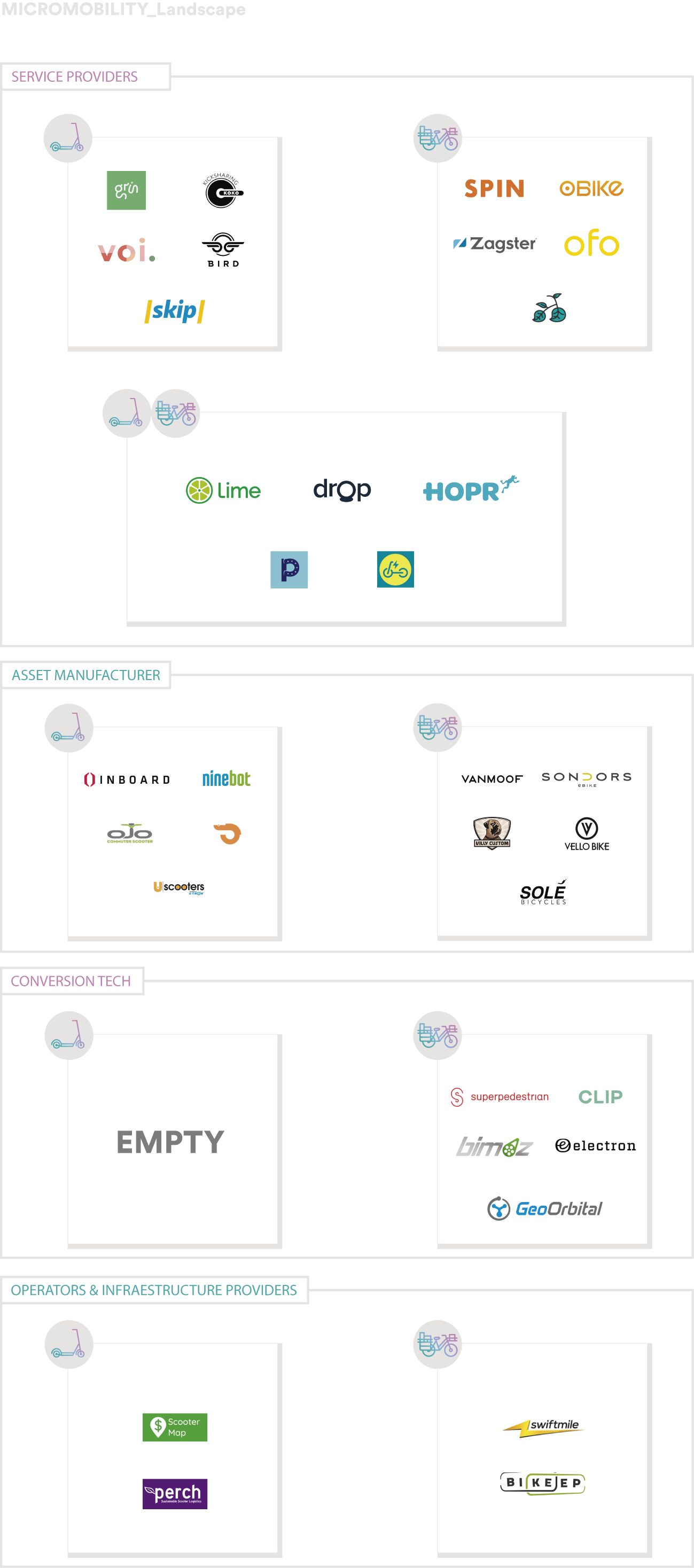

To understand what is happening we have decided to update a landscape made by CB Insights just a few months ago (14/06/2018). In the post, we can see a landscape and the accumulative size of rounds, called “bike & scooter tech”. In this “collection” they aggregate the different service providers, but also a lot of different segments related to it (manufactures, operators, infrastructure, aftermarket devices…).

Six months later, we decided that it was time to separate the service provider from the rest. This allows us to watch the size of the startups changing how people move in the city. The results are the following charts. Is important to note that 1) we only track startups, not companies that applied to tender in the traditional way, what we can call the incumbents in the bike-sharing scene. 2) the following deal information is only related to “Service providers” (the first box of the chart). In this category, we have tracked 73 startups, between bike and scooter service providers. And this setting aside motorbike-sharing, what in our opinion fits quite well in micro-mobility.

Source: B4Motion

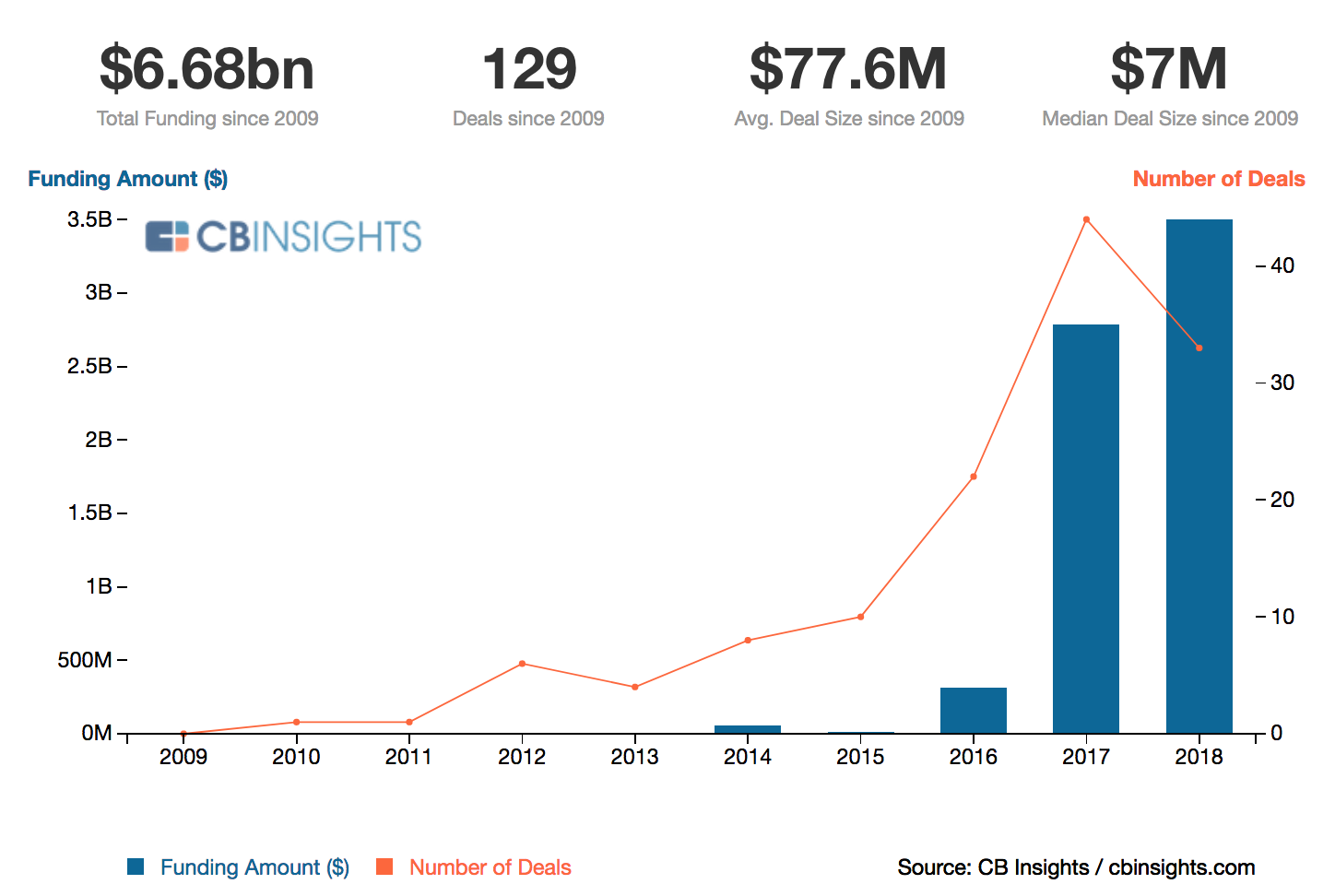

Source: CB Insights

In our CB Insights collection, we have 75 startups counting service providers, manufacturers and operators, and infrastructure providers. In other words, $6.68 billion invested in companies trying to the solve first, the last mile and chaining the multimodal trips.

In other words, $6.68 billion invested in 6% of the trillion miles made yearly (the blue one).

[EMBED]

This is why so many incumbents are jumping into it:

Daimler developing its own escooter-sharing service throw MyTaxi.

Ford has created Jelly, an escooter-sharing.

Ford Gobike.

GM developing two models of ebikes. Backed with Onstar capabilities.

Volkswagen cargo e-bike.

Lyft Motivate, and also Lyft escooter-sharing service.

Uber Jump bikes, and Jump are developing an escooter-sharing service.

Cabify and Movo.

Didi acquired Bluegogo and integrate Ofo and Bluegoggo in its app.

Meituan acquired Mobike.

The creators of 99taxi, after selling it to Didi, have jumped into bikes-haring and escooter-sharing operator (Yellow).

SEAT will launch an escooter-sharing service (eXS), initial in Spanish cities, in 2019.

Cabify, throw its micromobility (Moto-sharing) Movo will deploy 20.000 escooters in LATAM and Spain.

…

The Future

Bundle: M&A and partnerships

In the next 3 to 5 years we are going to see, in parallel, new players entering the category, M&A and partnerships oriented to offer bundle mobility options (Bike + scooter, scooter + motorbikes, bike + cars).

The first sign is already here. eCooltra partnering with eMov, Grin merge with Ride. A lot of companies offering different assets in its platform; but that were born just offering one (look at the landscape above). And finally, juggernauts of mobility like Uber, Grab, Lyft, Go-Jek… developing its green walled strategies.

Source: eCooltra & eMov. Dropmobility. Joyride

Last-mile Mobility for the disabled

Right now people that fit in this group has been erased from the plans of most of the urban mobility companies. One exception is Shuttle services that are targeting them like main customers. However, like always happens, people are on its path. Images below shows people using e-scooter services as the engines of their wheelchairs. It is quite relevant and shows how micro-mobility services can solve their problems too. There are currently companies selling aftermarket devices already designed for this purpose.

Source: Twitter

The idea is not to create a separate service. The point is to integrate it into the currently existing ones.

Last mile of goods

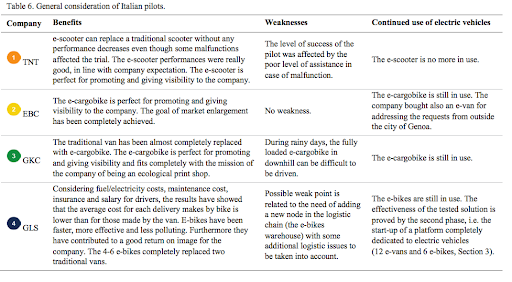

There are several pilots around the world. Some of them has been stopped, like TNT, who finished their test but claiming that “e-scooter can replace a traditional scooter without any performance decreases even though some malfunctions affected the trial.” Also, most of them have overcome the pilot phase like EBC, GKC, and GLS.

Source: ResearchGate

Both, traditional companies and new players (last-mile delivery) are pursuing a better workforce outlook. Among this potential gain, the vehicle and the information to operate their business could increase services/hour at that point in which longer wages are so far to generate more operating margin in almost all operators.

The way to offer services as B2B pivots on the idea of public-private sharing operational fleets. Most of this vehicles have a decrease or valley hours when logistics enter on their peaks. However, pricing and no option to customize via add-ons these vehicles are the main barriers to operate on this “2” customer scenario.

During the last six months, dedicated business fleets are spreading among European countries, but this purpose services lack flexibility and are generally tied to working hours. They are also hard to scale. A combined fleet (white-labeled for businesses) could improve utilization index and even allow new companies to operate with the free-assets business model (not owning or maintaining their fleets). The more players are integrated on the platform back and front) the more accessible the way to build flat rate, subscription or other business/gig workers solution. This user is demanding convenience, intelligence and flexibility to enter on the discussion of not having their operational vehicles (bike, car or any other business vehicle).

All of this leads us to a discussion between two concepts, that in reality is a discussion between two different ways to approach multimodal mobility: MOD Vs. MaaS. But we will leave that discussion for the next post.